(Bloomberg) — Palm oil is heading for a recovery in the second half on improving global demand and dwindling output, months after the coronavirus shattered the tropical oil’s stunning bull run.

Demand for the world’s most-consumed cooking oil, used in everything from chocolate to ice-cream, lipstick and shampoo, is poised to recover as lockdowns across the globe begin to ease and major consumers, including China and India, are boosting purchases to replenish stockpiles.

The Malaysian Palm Oil Council predicts prices will hit a peak of 2,594 ringgit ($605) per ton in the second half, and average at 2,337 ringgit this year, if Indonesia and Malaysia proceed with their biodiesel blending mandates as planned, and Europe’s oilseed production eases, paving way for buyers to switch to palm.

Benchmark futures in Malaysia, now trading at around 2,318 ringgit, started racing higher at the end of 2019, before the coronavirus pulled the plug on demand, first in China and then in other major consumers, as governments shut borders and businesses to stop the spread of the pandemic.

Facing unprecedented headwinds, prices started tumbling in January and slumped to a 10-month low of 1,946 ringgit a ton on May 6, as fruit yields picked up pace, stockpiles ballooned and biodiesel programs in top growers Indonesia and Malaysia came under heavy scrutiny. Veteran analyst Dorab Mistry called it a “cruel season” for palm oil. Prices have dropped 23% so far this year, compared with an 18% decline in rival soybean oil.

Concerns about a new wave of virus infections, extended lockdowns in some countries and re-emerging trade friction between the U.S. and China may cloud palm’s outlook. Here’s what industry participants are watching:

Poor Production

The impact of dry weather and reduced fertilizer application by farmers last year have spilled into 2020, hurting production of palm fruit. While output in Indonesia and Malaysia probably gained in the January-June period, yields in the second half, which accounts for about 60% of annual production, may wane.

Indonesia’s crude palm oil production may be 1 million to 2 million tons lower than last year’s 44 million tons due to dry weather and less fertilizer usage, according to Fadhil Hasan, director at PT Asian Agri, one of the largest growers. Output in Malaysia may drop 4.3% to 19 million tons due to biological stress on trees and limited labor supply, according to the Malaysian Palm Oil Board.

“Going into the new normal era, we must evolve into more efficient operations as this is a labor-intensive industry,” said Joko Supriyono, chairman of the Indonesian Palm Oil Association. “The pandemic is a trigger for the industry to change — we can no longer enjoy good margins, and to exist in any market we must became more cost-efficient.”

Demand Hopes

The appetite for palm oil may recover in the coming months as lockdowns are relaxed across the world, especially in India and China. However, it’s still uncertain whether consumption can fully recover.

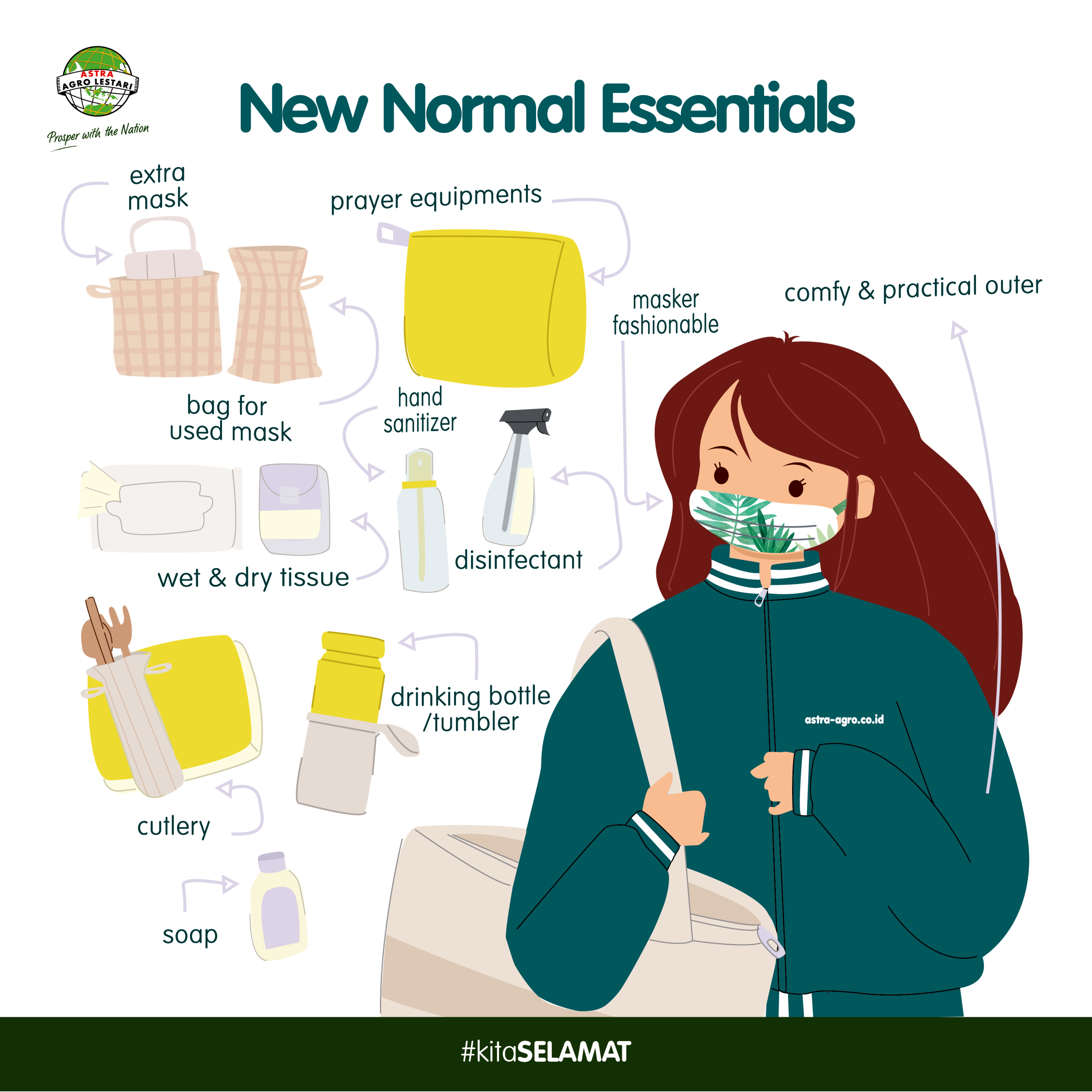

Malaysia is poised to benefit as India and China open up, prices are relatively lower than Indonesian rates and trade ties between Malaysia and India are warming, said Sathia Varqa, owner of Palm Oil Analytics in Singapore. Edible oil consumption will return, while oleochemicals demand will surge due to its use in personal hygiene products such as soaps and hand sanitizers, as well as personal protective gear.

However, palm is still facing a supply glut, which may climb to a peak that’s “well above” 3 million tons by the year-end, James Fry, chairman of LMC International, said at an online seminar last week.

Biodiesel Willpower

Biodiesel demand may still suffer as people continue to avoid traveling around the world, according to Howie Lee, an economist at Oversea-Chinese Banking Corp. in Singapore. Indonesia’s political will to maintain its B30 biofuel mandate is also at stake, he said.

Indonesia’s trade ministry now expects biofuel consumption at close to 8 million kiloliters this year, down from a target of 9.6 million kiloliters at the start of the year. Malaysia has postponed its B20 mandate, or 20% blending with diesel, in parts of the country as the pandemic delays the infrastructure push needed for higher biofuel use.

Petroleum prices will be crucial for palm in the coming months and investors will keep an eye on any move of the OPEC+ alliance to restrict production. Higher gasoil prices will help reduce the discount to palm oil and may revive blending of palm-biodiesel.

Trade Tensions

Growing tension between the U.S and China may frustrate bulls in the second half, as it could weigh on equities, futures and commodities, including palm. But friction could threaten the phase one trade deal and hurt China’s buying of U.S. soybeans, opening an opportunity for palm, according to Varqa.

What to Watch in Commodities: Winners and Losers in Second Half

Relations between Malaysia and India also need to be watched. India has ramped up purchases of Malaysian palm oil, thanks to export duty exemptions and warmer diplomatic ties following a politically-linked trade row last year.

New Infections, La Nina

The deadliest pandemic of the modern era is stronger than ever, with the coronavirus case count surging past 10 million. Even as investors brace for post-pandemic economic recession, fears of a new wave of infections remain.

Weather-related risks also lurk on the horizon. Australia’s Bureau of Meteorology last week raised its ENSO Outlook to ‘La Nina Watch’, with the chance of a La Nina forming during the southern hemisphere spring increasing to around 50%, twice the normal likelihood.

La Nina, a cooling of the tropical Pacific, can bring wetter-than-normal weather to Malaysia and Indonesia, where most of the world’s palm is grown.

Source: Bloomberg